Real-Time Recurring Payment

Using Real-Time Recurring Payment

Recurring payments are a cornerstone of modern

billing for subscription services, utilities, memberships, and B2B

contracts. However, traditional recurring payment methods—like ACH

or credit cards—often result in delays, failed transactions, and

inconsistent reconciliation.

Recurring payments are a cornerstone of modern

billing for subscription services, utilities, memberships, and B2B

contracts. However, traditional recurring payment methods—like ACH

or credit cards—often result in delays, failed transactions, and

inconsistent reconciliation.

That’s where Real-Time Recurring Payments come in, powered by both FedNow® and RTP® (Real-Time Payments). With these instant payment networks, businesses can request and receive funds from customers automatically, securely, and 24/7—even on weekends and holidays.

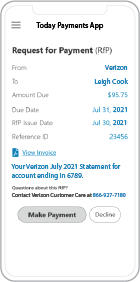

At TodayPayments.com, we help businesses modernize billing with real-time recurring transactions using Request for Payment (RfP) messaging, supporting both static and variable amounts, across multiple banks and financial institutions.

Attributes of Real-Time Recurring Payment for your business using instant payments

What Is a Real-Time Recurring Payment?

A Real-Time Recurring Payment is an automated billing process where a business sends a digital Request for Payment (RfP) to a customer, who then authorizes the transaction through their bank. Once approved, the payment is transferred instantly via FedNow® or RTP®.

Key features include:

- Real-time fund movement from payer to payee

- Authorization from the payer each cycle, increasing transparency and control

- Support for fixed (static) or flexible (variable) billing amounts

- Instant confirmation of payment status and availability

This approach improves both payment success rates and customer trust.

Always-On Billing with FedNow® and RTP®

Unlike legacy payment systems, FedNow® and RTP® operate continuously:

- Process recurring payments 24/7/365, including nights, weekends, and holidays

- Eliminate delays caused by bank cutoffs or batch windows

- Enable real-time reconciliation and balance updates

TodayPayments.com connects your business to these networks through a simple online setup—no branch visits or paperwork delays.

Flexible Recurring Setup Using Alias-Based Billing

Real-Time Recurring Payments become even more powerful with alias-based billing identifiers. Our system lets you:

- Use cell phone numbers or email addresses as billing aliases

- Create multiple MIDs (Merchant Identification Numbers) for different billing categories, services, or customer groups

- Route recurring payments across multiple banks and credit unions in all 50 states

This gives you scalable control for managing a large number of subscriptions or customer profiles without increasing complexity.

Ideal for Subscription, Service, and Utility Businesses

Our Real-Time Recurring solution supports any industry where recurring billing is critical, including:

- SaaS platforms and digital services

- Membership and gym management

- Professional services and retainer billing

- Utility, telecom, healthcare, and insurance payments

- Government payments, taxes, and public services

You can send automatic, branded RfPs to your customers and receive real-time payments that match your billing cycles exactly.

Hosted Payment Pages and ISO 20022-Compliant Messaging

Our platform includes tools to simplify and streamline the customer experience:

- Hosted Payment Pages for branded, mobile-friendly checkout

- ISO 20022-compliant Request for Payment (RfP) messaging embedded into invoices or email notifications

- Customer click-to-pay functionality with instant authorization

Customers get a seamless, secure payment process while you receive cleared funds in real time.

QuickBooks® Integration and Real-Time Reporting

Recurring payments integrate directly with your accounting systems. We support:

- Real-time sync with QuickBooks® Online (QBO)

- Auto-matching of recurring transactions to invoices

- Dashboard reporting for recurring payment status, aging, and reconciliation

This helps you keep your books accurate and your receivables current—without manual entry.

Attributes and elements of a Real-Time Recurring Payment system encompass various components necessary for its functionality, efficiency, and security. Here's a breakdown of key attributes and elements:

- Frequency: Specifies how often payments recur, such as daily, weekly, monthly, etc.

- Amount: Defines the payment amount for each transaction, which can be fixed or variable.

- Start Date: Indicates the date when the recurring payments commence.

- End Date or Duration: Specifies whether the recurring payments have an end date or continue indefinitely.

- Authorization: Ensures that the payer has given explicit consent for the recurring payments to be processed.

- Payment Method: Specifies the preferred method of payment, such as credit card, bank transfer, or digital wallet.

- Integration with Financial Systems: Enables seamless integration with banking platforms, accounting software, or payment gateways for efficient transaction processing and reconciliation.

- Error Handling: Implements robust error handling mechanisms to address payment failures, insufficient funds, or other issues.

- Security Measures: Incorporates security protocols to safeguard sensitive financial information and prevent fraud, including encryption, authentication, and compliance with regulatory standards.

- Notification and Confirmation: Provides timely notifications and confirmations to both the payer and payee for each transaction, ensuring transparency and accountability.

- Customer Support: Offers dedicated support channels to assist users with setting up, managing, and troubleshooting recurring payments.

- Reconciliation: Facilitates reconciliation of payment records with bank statements or accounting records to ensure accuracy and integrity of financial data.

- APIs and Integration Tools: Provides APIs and integration tools for seamless integration with third-party applications and systems.

- Scalability: Ensures scalability to accommodate growth and increasing transaction volumes over time.

- Compliance: Adheres to regulatory requirements and industry standards to ensure compliance with relevant laws and regulations.

By incorporating these attributes and elements, a Real-Time Recurring Payment system can effectively automate payment processing, enhance user experience, and streamline financial operations for businesses and individuals alike.

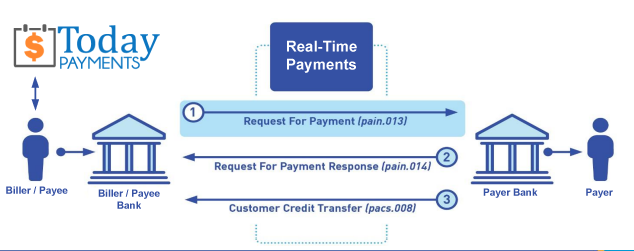

Creation Recurring Request for Payment

We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-TimePayments.com to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", either FedNow or RTP, will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

ACH and both Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions

The versions that

NACHA recommends for the Request for Payment message and the Response to the Request are pain.013 and pain.014

respectively. Version 5 for the RfP messages, which

The Clearing House Real-Time Payments system has implemented, may also be utilized as

there is no material difference in the schemas. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP ® and FedNow ® versions are Credit Push Payments.

Payees ensure the finality of Instant Real-Time

Payments (IRTP) and FedNow using recurring Requests for

Payments (RfP), Payees can implement certain measures:

1.

Confirmation Mechanism:

Implement a confirmation mechanism to ensure that each

payment request is acknowledged and confirmed by the payer

before the payment is initiated. This can include requiring

the payer to provide explicit consent or authorization for

each recurring payment.

2.

Transaction Monitoring:

Continuously monitor the status of recurring payment

requests and transactions in real-time to detect any

anomalies or discrepancies. Promptly investigate and resolve

any issues that arise to ensure the integrity and finality

of payments.

3.

Authentication and

Authorization: Implement strong

authentication and authorization measures to verify the

identity of the payer and ensure that only authorized

payments are processed. This can include multi-factor

authentication, biometric verification, or secure

tokenization techniques.

4.

Payment Reconciliation:

Regularly reconcile payment transactions to ensure that all

authorized payments have been successfully processed and

finalized. This involves comparing transaction records with

payment requests to identify any discrepancies or

unauthorized transactions.

5.

Secure Communication Channels:

Utilize secure communication channels, such as encrypted

messaging protocols or secure APIs, to transmit payment

requests and transaction data between the payee and the

payer. This helps prevent unauthorized access or

interception of sensitive payment information.

6.

Compliance with Regulatory

Standards: Ensure compliance with

relevant regulatory standards and guidelines governing

instant payments and recurring payment transactions. This

includes adhering to data security requirements, fraud

prevention measures, and consumer protection regulations.

By implementing these measures, Payees can enhance

the finality and security of Instant Real-Time Payments

using recurring Requests for Payments, thereby minimizing

the risk of payment disputes, fraud, or unauthorized

transactions.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing